Fascination About Dubai Company Expert Services

Wiki Article

Dubai Company Expert Services Fundamentals Explained

Table of ContentsA Biased View of Dubai Company Expert ServicesThe 4-Minute Rule for Dubai Company Expert ServicesRumored Buzz on Dubai Company Expert ServicesNot known Factual Statements About Dubai Company Expert Services An Unbiased View of Dubai Company Expert ServicesThe Only Guide for Dubai Company Expert ServicesWhat Does Dubai Company Expert Services Mean?

The personal income tax rate is additionally reduced as contrasted to various other countries. One of the largest advantages of signing up a business in Singapore is that you are not needed to pay tax obligations on funding gains.

It is very easy to begin organization from Singapore to anywhere in the globe.

The start-ups identified through the Start-up India initiative are supplied sufficient benefits for starting their own service in India. According to the Start-up India Action strategy, the followings conditions must be met in order to be eligible as Start-up: Being incorporated or signed up in India up to ten years from its date of incorporation.

The Dubai Company Expert Services Statements

100 crore. Any individual interested in establishing up a start-up can fill up a on the website and upload certain papers. The government also supplies checklists of facilitators of patents as well as hallmarks.The government will certainly birth all facilitator fees as well as the start-up will certainly bear only the statutory charges. They will certainly appreciate 80% A is set-up by federal government to give funds to the start-ups as equity capital. The federal government is likewise giving warranty to the lending institutions to encourage financial institutions and also various other banks for giving financial backing.

This will aid start-ups to draw in more investors. After this strategy, the start-ups will have an option to choose in between the VCs, providing the liberty to choose their investors. In situation of exit A start-up can shut its company within 90 days from the date of application of ending up The government has recommended to hold 2 start-up fests annually both across the country and also internationally to enable the different stakeholders of a start-up to satisfy.

Facts About Dubai Company Expert Services Revealed

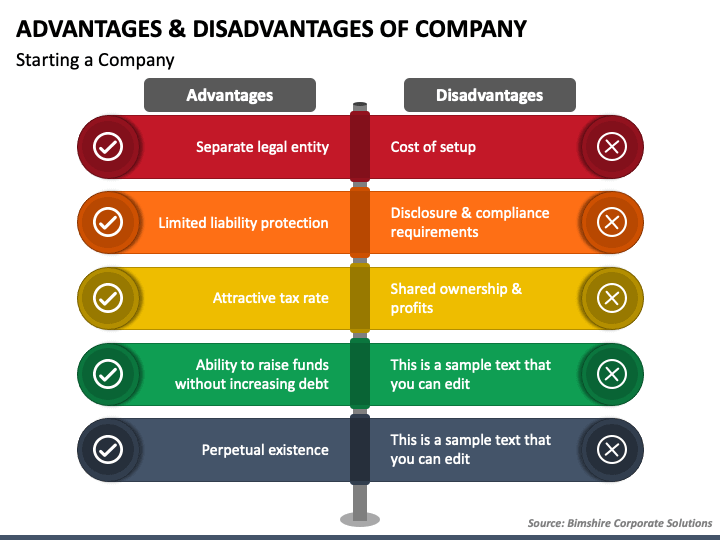

Limited firms can be a great option for many home capitalists yet they're not appropriate for everybody. Some property owners may in fact be far better off having residential or commercial property in their personal name. We'll cover the advantages and disadvantages of restricted firms, to help you choose if a minimal company is the right alternative for your residential property investment organization.As a business supervisor, you have the adaptability to choose what to do with the revenues. You can purchase additional buildings, save into a tax-efficient pension or pay out the revenue tactically making use of rewards. This adaptability can aid with your personal tax planning compared to directly owned homes. You can learn more regarding tax obligation for property investors in our expert-authored guide, Introduction to Real Estate Tax.

In which situation, Section 24 would influence your revenues. If your incomes are increasing, this is most definitely something you need to maintain a close eye on and you could wish to take into consideration a minimal company. There are added legal and financial responsibilities to consider. As a director of a firm, hop over to these guys you'll lawfully be required to keep precise firm and also financial documents as well as send the appropriate accounts as well as go back to Companies Home and also HMRC.

Not known Factual Statements About Dubai Company Expert Services

That's precisely what we do here at Provestor: we're a You'll need to budget around 1000 a year for a limited company accountant and make certain that the tax obligation advantages of a restricted business outweigh this extra cost. Something that not many people talk concerning is dual taxes. In a minimal firm, you pay company tax on your profits. Dubai Company Expert Services.It's worth locating an expert minimal business home loan broker who can discover the finest offer for you. Crunch the numbers or conversation to a specialist to make certain that the tax savings exceed the added expenses of a restricted business.

A private limited company is a type of firm that has limited responsibility and shares that are not easily transferable. The proprietors' or members' properties are hence protected in the occasion of company failing. Still, it must be stressed, this security just uses to their shareholdings - any money owed by the company stays.

The smart Trick of Dubai Company Expert Services That Nobody is Discussing

However, one significant disadvantage for new organizations is that establishing up a personal limited firm can be made complex and pricey. To shield themselves from responsibility, business must comply with certain procedures when integrating, consisting of filing write-ups of association with Firms Home within 2 week of incorporation and the annual verification statement.

One of the most typical are Sole Trader, Partnership, and also Private Restricted Company. There are lots of advantages of a private restricted firm, so it is the most prominent alternative. Here we will be discussing the benefits of a Personal Minimal Company. Limited Obligation One of the most significant advantage of a personal restricted firm is that the owners have limited responsibility.

If the business goes insolvent, the proprietors are just accountable for the quantity they have actually spent in the firm. Any firm's money stays with the firm and does not i thought about this fall on the owners' shoulders. This can be a substantial benefit for brand-new businesses as it safeguards their possessions from prospective company failures.

6 Simple Techniques For Dubai Company Expert Services

Tax obligation Effective Private restricted business are tax reliable as they can declare company tax alleviation on their revenues. In enhancement, there are numerous various other tax advantages readily available to firms, such as capital allocations and R&D tax credit ratings.

This means that the company can acquire with other organizations and individuals and is liable for its financial obligations. The only money that can be declared straight in the firm's commitments and not those incurred by its owners on behalf of the company is investors.

This can be helpful for small companies that do not have the time or resources to handle all the management jobs themselves. Flexible Administration Structure Personal restricted business are well-known for sole traders or local business that do not have the sources to establish up a public restricted business. This can be beneficial for companies that intend to keep control of their operations within a tiny team of people.

See This Report about Dubai Company Expert Services

This is due to the fact that exclusive minimal business are a lot more credible and also well established than sole investors or partnerships. Furthermore, exclusive limited firms usually have their website and also letterhead, offering consumers and distributors a sense of rely on business. click to read Defense From Creditors As discussed previously, among the vital benefits of a personal minimal company is that it provides defense from creditors.If the business enters into debt or insolvency, financial institutions can not seek direct repayment from the individual properties of business's proprietors. This can be crucial protection for the investors and also directors as it limits their responsibility. This implies that if the business declares bankruptcy, the owners are not directly liable for any type of money owed by the firm.

Report this wiki page